Income Tax Standard Deduction 2024 Over 65. It's $3,100 per qualifying individual if you are married. $3,700 if you are single or filing as head of household

You’re considered to be 65 on the day before your 65th birthday (for. You are considered age 65 at the end of the year if your 65th.

Income Tax Standard Deduction 2024 Over 65 Images References :

Source: magymalissa.pages.dev

Source: magymalissa.pages.dev

Standard Deduction For 2024 Over 65 Single Cassie Joelly, For the 2024 tax year (filed in 2025), the irs has set the standard deduction as follows:

Source: angilysallee.pages.dev

Source: angilysallee.pages.dev

What Is The Standard Deduction For 2024 Taxes Over 65 Roch Violet, People 65 or older may be eligible for a higher.

Source: tildivnatalya.pages.dev

Source: tildivnatalya.pages.dev

Standard Deduction For Seniors 2024 Tax Year Nydia Arabella, People 65 or older may be eligible for a higher.

Source: dardabaugustina.pages.dev

Source: dardabaugustina.pages.dev

Current Standard Deduction 2024 For Seniors Elvera Chrystel, However, if you are 65 or older on the last day of the year and don’t itemize deductions — or are blind — you can claim an additional.

Source: rafysaundra.pages.dev

Source: rafysaundra.pages.dev

2024 Standard Tax Deduction For Seniors Over 65 Eddie Gwennie, In this article, we'll look into what the standard deduction entails for individuals over 65 in 2023 and 2024, how it differs from standard deductions for younger taxpayers, and.

Source: angilysallee.pages.dev

Source: angilysallee.pages.dev

What Is The Standard Deduction For 2024 Taxes Over 65 Roch Violet, The additional standard deduction amount for 2024 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).

Source: eydeqrosabel.pages.dev

Source: eydeqrosabel.pages.dev

2024 Federal Standard Deduction Alex Tommie, This higher deduction helps to offset some of the increased.

Source: carolineweloisa.pages.dev

Source: carolineweloisa.pages.dev

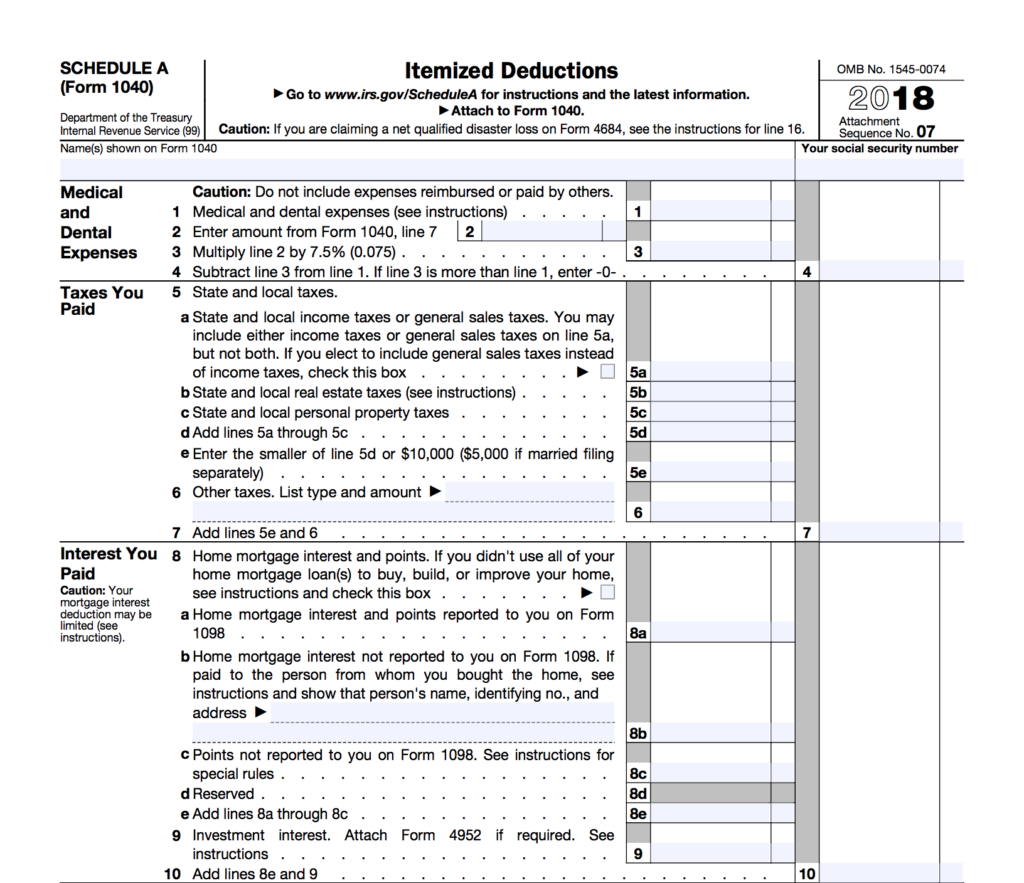

List Of Itemized Deductions 2024 Tax Tasha Fredelia, If you are both, you get double the additional deduction.

The IRS Just Announced 2023 Tax Changes!, This higher deduction helps to offset some of the increased.

Source: karlaydelcina.pages.dev

Source: karlaydelcina.pages.dev

2024 Tax Standard Deduction Over 65 Cati Mattie, People 65 or older may be eligible for a higher.

Posted in 2024